Speaker: Associate Professor Wang Liang (the Department of Economics, University of Hawaii Manoa)

Host: Assistant Professor Yang Cheng(Li Anmin Institute of Economics, Liaoning University)

Guest introduction: Assistant Professor Hou Shangdi(China Institute of Economic, Liaoning University)

Time: June 24, 2024 (Monday) 10:00-11:30 (Beijing time)

Location: Conference Room, 1st Floor, Wuzhou Park, Chongshan Campus, Liaoning University

Online Venue: Tencent Meeting:350-910-459

Language: Chinese/English

Abstract: There have been two competing views on the structure of the international monetary system. One sees it as a unipolar system with a dominant currency, such as the U.S. dollar, while the other argues that multiple international currencies can coexist. Aiming to provide a unified theoretical framework to reconcile these two views, we develop a micro-founded monetary model to examine the interactions of two essential roles played by international currencies, the medium of exchange and the store of value, and highlight the importance of abundant safe asset supplies. When the two roles of international currencies reinforce each other, a unipolar equilibrium exists. However, when one currency is unable to serve as sufficient safe assets for international trade transactions, the two roles work against each other. Agents have the incentive to diversify their portfolio and we have a multipolar system. The effects of monetary policy, fiscal policy, and their combinations crucially depend on the total supply of safe assets and the relative importance of the two functions of international currencies. The structure of the international monetary system could be influenced by various policies such as monetary policy, fiscal policy, and financial sanctions. We also discuss welfare under different equilibria and the effect of financial sanctions on the dominant currency in a unipolar world.

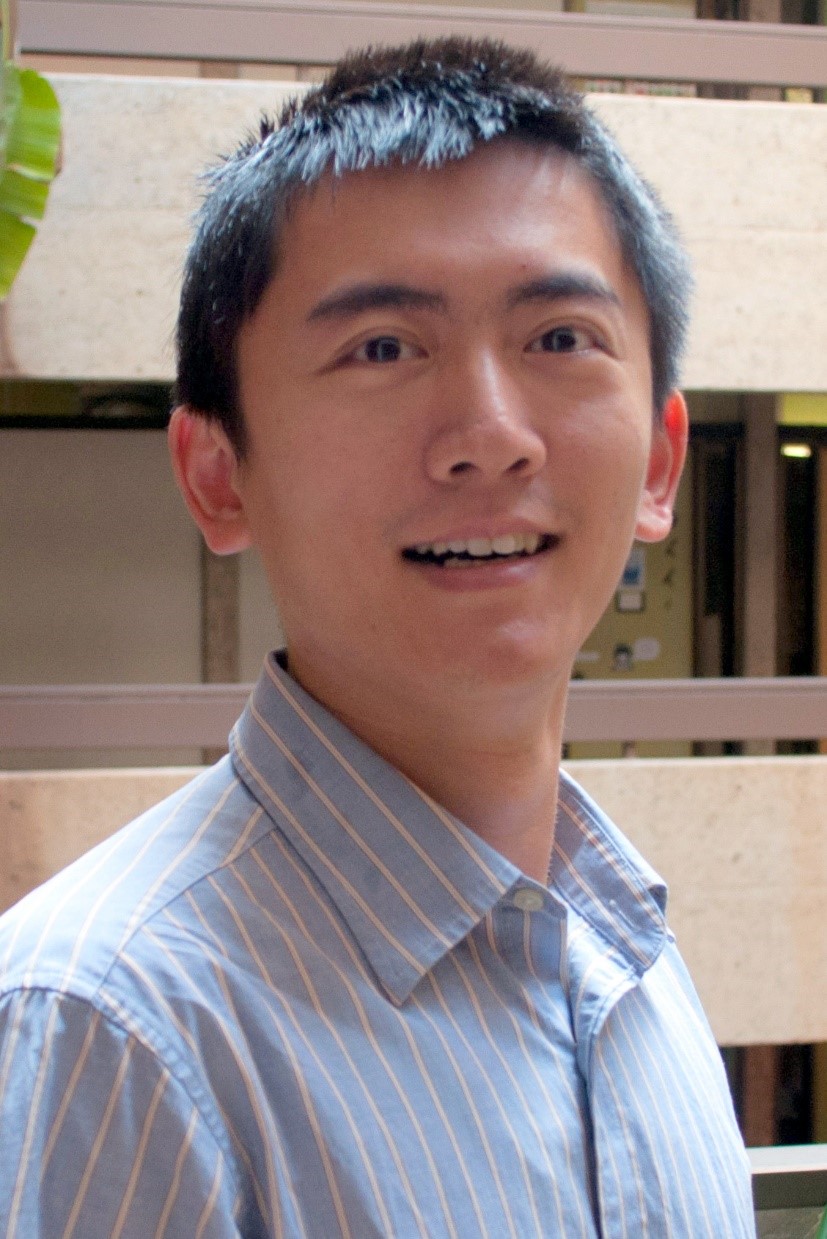

Introduction to the speaker:

Dr. Liang Wang received his Ph.D. in Economics from the University of Pennsylvania. He is an associate professor and graduate chair in the Department of Economics, University of Hawaii Manoa. His research focuses on monetary economics, macroeconomics, labor economics, and search and matching theory. In particular, he has applied dynamic stochastic general equilibrium models with micro-foundations to study inflation, price dispersion, interest rates, banking, and asset pricing. Currently, he is working on projects related to international monetary system, CBDC, and OTC markets. His work has been presented at many international conferences and published in leading economics journals including Journal of Economic Theory, Journal of Economic Dynamics and Control, International Economic Review, and European Economic Review. Dr. Wang serves as an anonymous referee for many economics journals and he has been a visiting scholar to universities and central banks in different countries, including Emory University, Australian National University, Federal Reserve Bank, and Bank of Canada.